A year after the Russia-Ukraine War

It has been over a year since Russia first invaded Ukraine in February 2022, with economic impacts rippling outside Ukraine. The Russian invasion demonstrated how fragile the pillars of safety and security actually were.

An Impending Recession?

On the first Wednesday of May, the Federal Reserve raised interest rates yet another time at the Federal Open Market Committee meeting.

Is a global recession inevitable in 2023?

The recession forecast is based on the prediction that the Federal Reserve will continue stepping up interest rates by a further 100 basis points through March next year. 2022 has been a year or ‘permacrisis’, a term coined by the editors of Collins English Dictionary to sum up the year, in a nutshell. 2022 has indeed been “an extended period of instability and insecurity” as the world recovered from the global pandemic, admittedly with a couple of painfully arduous hurdles that would drag on to the 2023 as it dawns. Three main crises have been the cause for consternation for most of us as we approach the next year, making the prediction of an inevitable global recession pretty much palpable.

What you need to know about the rising greenback

The dollar has been strengthening dramatically over the course of this year when the Federal Reserve started hiking interest rate hikes in a bid to bring down the skyrocketing inflation. The US Dollar Index, measuring the dollar against a basket of other currencies, is up nearly 17% so far this year, and that’s a significant rise, impacting almost every securities transaction and payment on a global scale.

Recession

The economy goes through cycles of peaks and troughs, just like the water waves. When the economy grows, its crest comes to a peak, declines to form the trough, then rises again. When the economy goes up, we are undergoing economic growth, but when it goes down, we find ourselves going through what is called an economic contraction.

Black Swans

The World Bank slashed its global growth forecast on Tuesday this week, sending out warning signals that many countries could fall into recession. In fact, some pundits predict that the economy we have today may very well slip into a period of stagflation mirroring the dark times in the ‘70s, a time that the older generation might find hauntingly familiar.

The Situation of Inflation Today

For the longest time, inflation has been the hot topic everyone has been discussing as a result of the Federal Open Market Committee (FOMC) meeting last Wednesday. In last week’s market roundup, we discussed the immediate impact of the Federal Reserve’s announcement on its biggest rate hike in a bid to slow the soaring inflation, with half a percentage point increase. The announcement led to an almost immediate rally in markets across the globe. However, soon after, we witnessed a downturn in the markets yet again. This volatility has proven to wrecking markets all over the world. US stocks have suffered the worst streak of weekly losses in more than a decade following days of turbulent trading surrounding the Fed’s latest decision. In this week’s monthly issue, we examine how the market’s reactions have swung to the other end of the pendulum, as well as the implications of inflation being a debacle that is extending to an almost global scale.

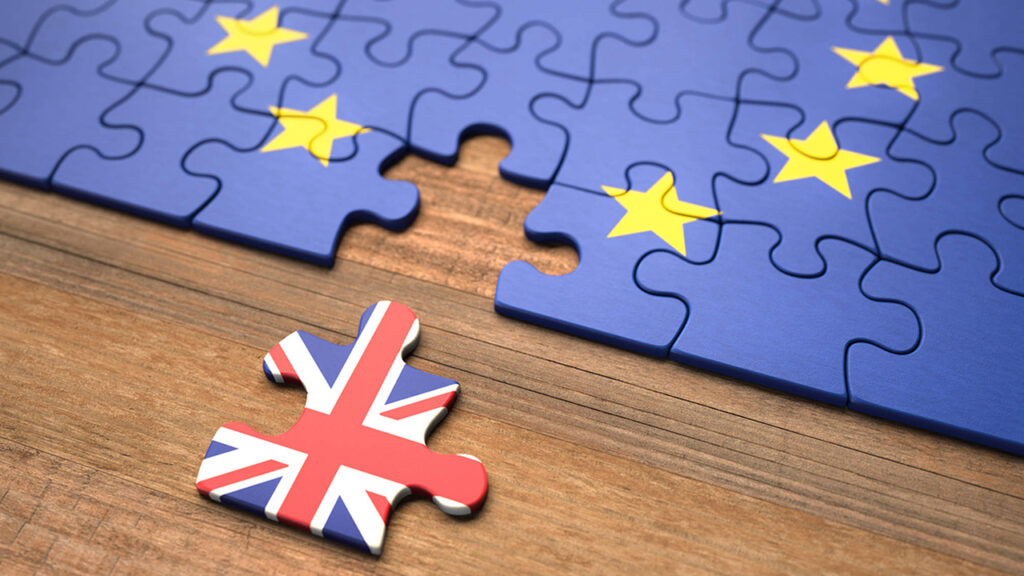

The divorce between UK and EU – what happens to the kids?

Those out there who have done some form of basic waltz would have learned the box step, where one moves right, left, forward sideways and exactly back to the start point. Well Brexit, for the past couple of years, has pretty much been like waltzing the box step as opposed to say, Tango, where you actually get somewhere away from your original point. It’s not to say that there wasn’t any progress in Brexit. But there is still much uncertainty in the eventual outcome of Britain’s withdrawal from the European Union (EU) even though the agreement has finally been made on 31 January 2020. It is certainly hard to tell at the moment whether the people of Britain are truly better off with the divorce.

The Must-Knows About Inflation Today

Inflation has been the talk of the town for the past many months so what exactly has been going on in this post-pandemic era? We have been receiving snippets of tapering news since the tail end of last year and it has been ongoing ever since. In today’s monthly issue, we will delve deeper into the concept of inflation and how it has impacted many nations especially since COVID took center stage in the past two years, resulting in unprecedented fiscal and monetary stimuli coming into play to curb the financial problems that tagged along the pandemic.