Nvidia: The Powerhouse Behind the AI Revolution

Phoebe Goh

14/06/2024

10 min read

Nvidia’s stock started trading on a new 10-for-1 split basis this week, adjusting the closing price of $1,208.88 on Friday to $120.88 on Monday. The shares rose almost 1% on the first day after the split.

Stock splits reduce the cost of individual shares, making them more accessible without eroding the overall value of current shareholders’ investments. Nvidia’s stock split will make its shares more accessible for significantly more retail traders. It is rare to have a stock over $1000 with 50% implied volatility; thus, the prices of the options are exceptionally high, and option traders have been looking forward to the split.

Following a brief surge in market valuation, surpassing $3 trillion, Nvidia executed a stock split. This move propelled the semiconductor company ahead of Apple, making it the second-highest valued publicly traded entity in the US. Nvidia’s shares have surged due to the growing interest in generative AI, triggered by OpenAI’s introduction of its ChatGPT software in late 2022. Since then, major tech companies, including Amazon, Google, and Microsoft, have been vying for Nvidia’s hardware to power their own generative AI platforms. This demand has significantly boosted Nvidia’s revenue. In the first quarter, Nvidia reported adjusted earnings per share of $6.12 and revenue of $26 billion, which are increases of 461% and 262%, respectively, compared to the same period the previous year.

Investors often perceive stock splits as an indication of a company’s robustness, and as a result, firms that undergo stock splits usually exhibit superior performance compared to the S&P500 in the subsequent year after the announcement. It does appear that Nvidia’s growth isn’t about the plateau just yet, so exactly what are the sources fueling its growth?

Growth sources

A fresh catalyst for Nvidia’s growth is the bulk acquisition of GPUs by governments across Asia, the Middle East, Europe, and the Americas. These governments are setting up domestic AI computing facilities, fueling demand for Nvidia’s products. The push to develop autonomous AI, by training extensive language models in their national languages using citizens’ data, is driving this demand. This move towards increased self-reliance is a strategic response to the escalating tensions between the US and China.

Nvidia has projected that its 2024 revenue will be boosted by $10 billion due to sovereign AI spending. a novel avenue for generating increased revenue. If more nations decide to invest heavily in custom generative AI capabilities, this could provide additional diverse revenue streams for Nvidia. The main challenge lies in maintaining this pace.

In addition to sovereign AI demand for its chips, other drivers of Nvidia’s growth includes Nvidia’s growth investment. The company’s aggressive pace of new product introductions will further drive future growth. Examples include Blackwell chips, which could possibly generate significant revenue for Nvidia in 2024, along with the company’s fast-growing InfiniBand line. Nvidia’s 427% increase in revenue from cloud service providers, which accounted for $22.6 billion in revenue, could slow down in the future. But with Nvidia’s forward-looking CEO Jensen Huang, it would not be surprising if the firm comes up with a stream of new growth investments to help sustain the company’s growing revenues.

In recent years, a significant factor driving the demand for Nvidia’s chips has been the necessity to conduct trillions of repetitive computations to train machine learning (ML) models. Some of these models, like OpenAI’s GPT-4, are enormous, boasting over 1 trillion parameters. Nvidia was a proactive supporter of OpenAI, even creating a unique compute module using its H100 processors to expedite the training of the company’s large language models (LLMs).

Additionally, Nvidia has encountered an unforeseen source of demand for its chips: cryptocurrency mining. These calculations can be executed more quickly and energy-efficiently on a GPU than on a CPU. The demand for GPUs for cryptocurrency mining resulted in a shortage of graphics cards for several years, positioning GPU manufacturers like Nvidia in a situation akin to the suppliers of pick-axes during the California Gold Rush.

A glimpse into Nvidia’s history

NVIDIA, established in 1993, was a pioneer in GPU/ASIC technology and one of the first to market these specialised chips to consumers.

In its initial two decades, the company focused on graphics and gaming. Its primary product, the GPUs, also known as “graphics cards”, were sold as additional components for consumer PCs. These products could be installed into the mainboard of a computer, requiring a desktop computer capable of modifications, not a laptop or tablet. This hardware was necessary primarily for intensive gaming and graphics applications, thus, the customer base was mostly composed of computer gaming enthusiasts and graphic designers.

This blend of hardware constraints and market limitations positioned graphics cards as a niche product. In the 90s and 2000s, NVIDIA set the industry standard in this area. Its main competitors have traditionally been AMD and Intel, with Intel primarily producing integrated graphics processors instead of additional hardware.

For the majority of its existence, NVIDIA has maintained its status as a leading provider of specialty products, significantly impacting semiconductor technology and manufacturing methods across the industry.

In 1999, NVIDIA went public, bolstered by its core products like the RIVA and GeForce processor lines. In the 2000s, it became a supplier for video game consoles, including the graphics cards for Microsoft’s X-Box and Sony’s PlayStation. During this time, the company also started venturing into light industrial applications, notably supplying graphics chips for automotive heads-up displays.

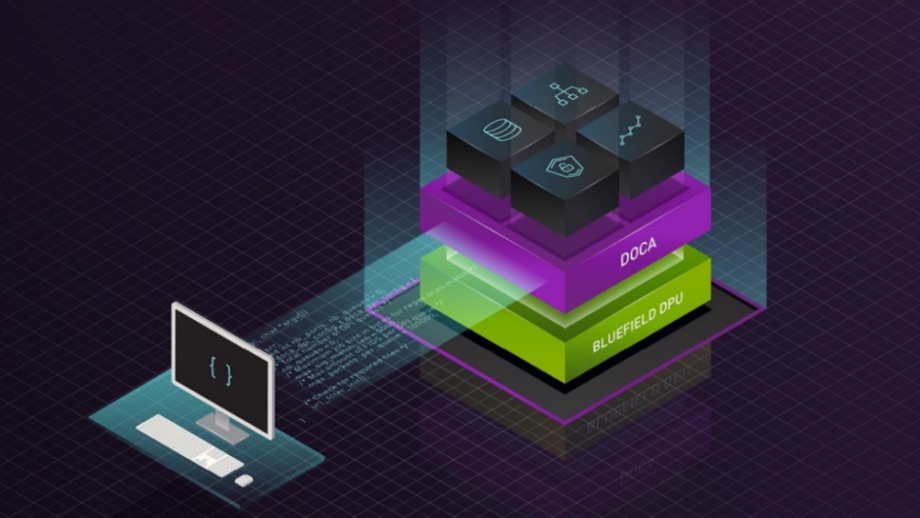

In the 2010s, NVIDIA saw its business model begin to shift. During this era, entirely new software industries emerged that focused more on single, high-demand tasks. This included blockchain mines, high-volume data storage and distribution, video streaming, and artificial intelligence. This was a change from previous industry emphasis on efficient software that did more with less hardware, and it was an excellent fit for NVIDIA‘s specialty chipsets. This was particularly successful due to the company’s CUDA line of products, released in 2006 and built for research-oriented applications.

Since 2010, NVIDIA’s business has moved steadily towards these industry-oriented practices. While the company still produces consumer graphics cards and arguably remains the industry leader in that field, its main revenue now comes from corporate processor demand. Its biggest customers currently include firms such as OpenAI, Amazon, Alphabet, Meta and Tesla.

Today, it is one of the biggest tech companies, running in second place after Microsoft, and it is also a main hardware supplier for major emerging technologies such as AI and cryptography.

The continued growth of Nvidia

Until 2020, Intel had a larger market capitalisation than Nvidia. However, the surge caused by the pandemic quickly turned into an AI revolution.

During the pandemic, the shift to remote work led to a substantial increase in demand for data centres capable of supporting cloud-based computing. In addition, with people being confined indoors, there was a significant uptick in interest in video games. These two factors combined to accelerate Nvidia’s revenues substantially. Concurrently, tech giants in Silicon Valley, led by OpenAI, started to grasp the immense potential of artificial intelligence (AI) to transform business operations across the industry spectrum.

Nvidia, with its robust ecosystem encompassing software and material sourcing, has positioned itself as the preferred source for companies in need of massive computing power to handle their AI requirements. This strategic positioning has led to a meteoric rise in Nvidia’s fortunes. Today, its worth is nearly $3 trillion, according to its current stock price.

Huang acknowledged last year that the company’s success was a result of both luck and skill. He held the belief that something new would eventually happen, and the rest hinged on serendipity. For Huang, it wasn’t foresight per se, but ‘foresight’ in the realm of accelerated computing that propelled them forward.

In the current scenario, almost every major tech company, including industry behemoths like Amazon, Google, Meta, Microsoft, and Oracle, has incorporated Nvidia chips into their operations. Bloomberg News has even referred to Nvidia’s chips as the “workhorse for training AI models”. PNC Financial Services Group analyst Amanda Agati has described Nvidia’s lead in the category, based on its valuation, as a “quasi-monopoly”.

Nvidia, with its three decades of GPU specialisation, represents the “dominant” infrastructure player in the current rise of the AI sector. While other chip designers are making efforts to catch up to Nvidia, the company’s extensive background in GPU specialisation gives it a formidable advantage.

The emerging field of AI is better supported by GPUs, and at present, Nvidia is providing the foundation for it in a majority of cases. Beyond this, Nvidia is also offering solutions for other sectors, like health care, that are not specifically tech-oriented. In these markets too, the company has managed to establish a strong lead.

Nvidia’s dominance in the tech industry

Nvidia’s unique expertise and specialised knowledge in the GPU market allow it to command high prices for its products. These chips, produced in Taiwan, stand out in a market where many companies are eagerly trying to develop their AI capabilities. The uniqueness and high demand for Nvidia’s chips have led to concerns about their scarcity, emphasising the importance of Nvidia’s role in the AI industry.

The Biden administration’s 2022 CHIPS and Science Act, designed explicitly to stimulate the production of GPUs within the United States, is already raising concerns about the country’s ability to keep pace with market demands. The Act’s intention is to bolster domestic production capacity, but the ambitious goals set forth are a clear indication of the significant challenges that lie ahead.

The estimated quantity of chips that AI companies anticipate needing is staggering, highlighting the potential scale of the task for domestic manufacturers. If the US wishes to be a significant contender in chip manufacturing, additional federal subsidies may be necessary. This need for increased investment underscores the critical nature of the semiconductor industry to the nation’s tech infrastructure.

Investor enthusiasm for Nvidia continues unabated, showcasing the company’s robust positioning in the market. Despite some speculations of a bubble, numerous Wall Street analysts argue that the company’s strong financial reports validate the viability of its product. These reports not only confirm Nvidia’s financial health but also its strategic positioning in the technology sector.

As Nvidia’s value has skyrocketed, its financial performance has become increasingly influential for major stock indices. This influence means that the trajectory of the stock market is closely tied to Nvidia’s performance, underscoring the company’s critical role in the broader financial landscape.

Indeed, Nvidia has become a pivotal player in shaping the market’s future. The saying ‘data is the new oil’ has become a common adage in the tech industry, and Nvidia consistently demonstrates its unparalleled status in this new data-driven economy. Its GPUs are the engines that power the extraction and refinement of this ‘new oil,’ making Nvidia an indispensable player in this digital age.

A Trader’s View

We shall look into the currency pair USD/JPY since there is some correlation between USD/JPY and the US stock index (i.e. S&P 500). This relationship may not hold all the time, as both markets can be influenced by a multitude of factors. In general, when stocks sell off, USD/JPY tends to sell off as well. It is also true that as stocks go bid, USD/JPY tends to go bid as well. This is because the Japanese yen is considered a safe haven asset. In times of risk aversion, investors tend to buy the Japanese yen as a safe haven currency, leading to a decrease in USD/JPY. Conversely, during risk-on periods, investors may sell the yen in favour of higher-yielding currencies like the US dollar, leading to an increase in USD/JPY.

Let’s look at the technical chart for USD/JPY below.

USD/JPY H4 Chart

From the above H4 chart for USD/JPY, it is currently trading at around 157.34. From a technical point of view, USD/JPY is still on an uptrend as supported by the trendline in blue. There is a support and resistance zone at around 153.60 and 160.20 respectively. Since the stochastic indicator is at an overbought level, there could be some retracement in USD/JPY before continuing in its overall uptrend. Personally, I would wait for USD/JPY retracement to the blue trendline before going long on USD/JPY or when USD/JPY reaches the 153.60 support zone. I would place my stop loss below 153.60 and my target level for USDJPY would be around the resistance zone at 160.20. Fundamentally, we should take note of upcoming major economic data and events like US CPI, federal funds rate, FOMC press conference, BOJ policy rate and BOJ press conference, which will affect USD and JPY.

Tan Zheng Xiang