How will 2024 fare with the Fed’s upcoming actions?

Phoebe Goh

12 January 2024

11 min read

2024 is a brand new year, and we are certainly hoping it will be a better one than the last couple of years we’ve had since the pandemic struck. The key economic question for us is this: how will the interest rate cuts we are likely to get from the Federal Reserve affect us, and is this good news for the economy or a sign of an impending recession as we witnessed historically in 2001 and 2007?

Despite disagreements about when and how much monetary easing should occur in light of recent inflation, Fed policymakers indicated in the minutes from their latest meeting, released on Wednesday last week, that interest rate reductions should start sometime this year.

A significant factor in this debate is the disparity in the post-pandemic economic recovery. Unlike the 2001 and 2007 rate cuts, which were implemented following a period of excessive investment or borrowing, the proposed policy easing this year would occur after portions of the economy sensitive to rates and cyclicality have experienced roughly two years of downturn. These sectors were already poised for some recovery in 2024, but the additional stimulus from rate cuts could transform this recovery into something more akin to a surge.

What are the areas affected?

US housing market

Undoubtedly, the housing market is the principal sector that feels the impact of interest rate changes. Notably, in an environment characterised by high interest rates, homebuilders have found a way to prosper. They’ve succeeded in drawing in potential buyers by presenting the appealing prospect of lower mortgage costs. However, this positive aspect has been somewhat overshadowed by a problem in the resale market. A scarcity of pre-owned homes available for purchase has led to a significant slowdown in resale activity. The existing home sales figures in recent times have dipped alarmingly, reaching lows that hark back to the financial crisis of 2008, when the subprime-mortgage bubble burst and Lehman Brothers Holdings Inc. collapsed.

This situation, though, can see a reversal with a decrease in home loan rates. A lowering of these rates can breathe new life into the currently sluggish resale market. It has the potential to provide an extra impetus to builders, who could benefit from the increased activity. In addition, homeowners stand to gain as well. With lower home loan rates, they could afford to undertake renovations and extensions that were previously shelved. These projects were put on hold as interest rates climbed and the fears of a recession loomed large.

Looking ahead, the recovery seems promising. Inflation-adjusted residential investment is projected to rise on a year-over-year basis. This represents a significant rebound from the heavily negative figures we saw in late 2022 and early 2023. This pattern of growth is something we’ve commonly observed in the aftermath of economic recessions in the US. By the time we reach spring, the housing market should be on an upward trajectory. This would mark the first instance of growth since the initial wave of rate increases began to affect the market.

Manufacturing sector

With a rebound in the housing market, there’s potential for the manufacturing sector to be revitalised, ending its prolonged period of underperformance. This underperformance can be traced back to a shift in consumer spending patterns in the spring of 2022. During this time, consumers started to pivot their spending away from tangible goods towards experiences, such as travel and leisure. This left many companies grappling with an oversupply of products. In response, they spent several business quarters actively decreasing their excess inventory levels instead of restocking their goods.

However, the anticipated rejuvenation of the housing market might serve as a catalyst for the manufacturing sector’s recovery. Lower home loan rates could stimulate consumer spending in the housing market, in turn leading to an increased demand for manufactured goods—everything from construction materials to home appliances. This could compel manufacturing companies to start rebuilding their product inventories, marking a departure from the recent trend of inventory depletion. This could potentially set the stage for a resurgence in manufacturing activity, thereby helping the sector to finally shake off its malaise.

High levels of inflation, escalating borrowing costs, and a decrease in new orders have led to a significant erosion of business confidence in the manufacturing sector. The ISM Manufacturing Index, a sentiment indicator that policymakers and industry analysts closely monitor, is proof of this. Over the past 14 months, this index has been continuously contracting—an unprecedented downturn that surpasses even the depths of the 2008 recession.

However, recent data suggest that the manufacturing sector may be starting to find its footing again, with the ISM Manufacturing Index showing tentative signs of stabilization. This hints at a possible turnaround in the industry’s fortunes, which is a welcome relief after a prolonged period of contraction.

Looking forward, there’s reason for cautious optimism. Industry forecasts predict an upswing in factory orders in the near future. This is expected to provide a much-needed boost to the manufacturing sector, potentially driving the ISM Manufacturing Index back into the realm of expansion. The increase in factory orders could signify a return to growth, heralding a new phase of expansion for the struggling manufacturing sector.

Banks

Banks serve as the concluding piece in this economic scenario. Over the past 18 months, banks have adopted a more cautious approach, particularly in their lending activities. This caution mainly came from the need to build up their capital to protect against possible losses.

In November, certain banks started to deliberate on the timing of a strategic shift from merely amassing capital to actively deploying it in the form of loans. This change in strategy has been facilitated by the recent significant reductions in long-term interest rates. These reductions have had a dual effect. Firstly, they have eased the cost of borrowing, making it more affordable for businesses and individuals. Secondly, they have helped to mend some of the damage inflicted on banks’ portfolios of US Treasury and mortgage-backed securities. The latter effect is particularly important, as many of these securities suffered impairment due to the previous rising interest rate environment.

The Federal Reserve’s Senior Loan Officer Survey provided an encouraging sign that this shift may be underway. The survey revealed that the net share of banks that had tightened lending standards for medium and large businesses had decreased in the third quarter compared to the previous three months. This trend suggests that banks are gradually moving from a phase of tightening to one of loosening their lending standards.

Looking ahead, it’s reasonable to expect that this trend will continue, leading to a broader relaxation of lending standards by the second or third quarter. This expectation is based on several factors. Chief among these is the fact that much of the previous tightening was not due to loan losses, which are typically associated with recessions. Instead, it was a response to the devaluation of high-quality securities that had been negatively affected by rising interest rates.

This anticipated relaxation in lending standards could have several positive implications for the economy. For one, it could facilitate greater access to capital for businesses, potentially stimulating growth and job creation. For another, it could encourage more investment in sectors like real estate and manufacturing, which are sensitive to changes in lending rates. In light of these considerations, the role of banks in this economic scenario is indeed significant and worthy of close attention.

But what are the odds of a recession in 2024?

This area becomes particularly perplexing when diving deeper. Would the Fed actually reduce rates, and how significant would that be? Typically, the employment market weakens gradually before experiencing a sudden break. This allows economists to form robust recession indicators based on the trend in employment growth. A consistent decline can reach a point where extensive layoffs become inevitable. A well-known example of this is the Sahm Rule, named after Claudia Sahm from Bloomberg Opinion. This rule declares the start of a recession if the three-month moving average of the national unemployment rate (U3) increases by 0.5 percentage points or more compared to its lowest point during the previous 12 months. Three months ago, unemployment appeared to be quickly approaching the 0.5 threshold. However, currently, employment figures are no longer definitively trending towards a recession.

While this is generally good news, it suggests that the Fed may not have the need, or even the rationale, to reduce overnight rates by more than a full percentage point over the coming 10 months. The unemployment data, however, is ambiguous, which allows Dhaval Joshi from BCA Research to offer a different perspective.

Joshi’s real-time US recession indicator signals a recession when the three-month moving average of the unemployment rate of ‘job losers not on temporary layoff’ rises by 0.20 percent from its low during the previous 12 months. [This rule] focuses on this ‘bad’ unemployment—individuals who are unemployed because they were let go from permanent jobs and are unable to find new employment. At present, the number of layoffs is low, but those who are laid off are having greater difficulty finding new employment. As a result, ‘bad’ unemployment has steadily increased.

On the other hand, he states that if the unemployment rate increases because more people are job hunting, then that could be considered “good” unemployment, caused by a rise in the participation rate. However, as we have seen, the participation rate is indeed declining, which is why this version of a recession indicator is so negative. Even though it tends to be pessimistic, it hasn’t yet reached a point that would definitively signal a recession.

The uncertain start to 2024 serves as a sobering reminder that, as the year-end rally showed, market sentiments were possibly overly optimistic at the end of the previous year. This realization is a healthy one, as it tempers expectations and brings a dose of realism to our views of the economic landscape. It’s also heartening to see that the strong push for extensive rate cuts, which was a prominent feature of market behavior recently, has been slightly scaled back. This adjustment in expectations, while subtle, is noteworthy.

In addition to this, some investors have chosen to cash in on their profits, a decision that is by no means a negative one. In fact, taking profits in a volatile market can often be a prudent strategy, providing both a buffer against potential downturns and liquidity for future investments. It should also be mentioned that the movements of the market, known as price action, ought not to be dismissed lightly. These movements often provide helpful signals about investor sentiment and the underlying strength of the market.

Despite recent events, many still believe the Fed made their expected policy shift last year. Because of this, they anticipate a lot of monetary easing this year. However, surprises in upcoming inflation data could challenge this belief, as it might change how we view the economy and how the Fed responds. Or, though it’s unlikely, an unexpected policy change by the Fed could also lead to rethinking this belief.

It is important to remember that economic forecasts and market expectations are not set in stone. They are constantly evolving in response to new data, policy announcements, and a multitude of other factors. As such, while the current consensus may lean towards significant monetary easing in 2024, any number of developments could potentially alter this view. As always, navigating these uncertainties requires a balanced approach, combining careful analysis of available data with a readiness to adapt to new information and changing circumstances.

A Trader’s View

For me, it’s still unclear if the Fed will begin lowering interest rates in February 2024. As of November 2023, there was a market consensus that, based on the Fed’s projections, the Fed would begin cutting as early as February 2024 and three times this year. Because of this, the dollar has declined since November 2023. It is highly probable that the stock market and bonds would experience significant gains if they were to make three cuts this year, each at 0.25 basis points.

Next, we have the presidential election this year, and historical data indicates that the stock market will perform favorably 83% of the time during presidential elections. As a result, it lessens the likelihood of a full-blown recession, though there will be a risk of a mild recession or soft landing in this case. Nevertheless, no expectations or economic projections are set in stone; we can only take one step at a time and let things unfold naturally.

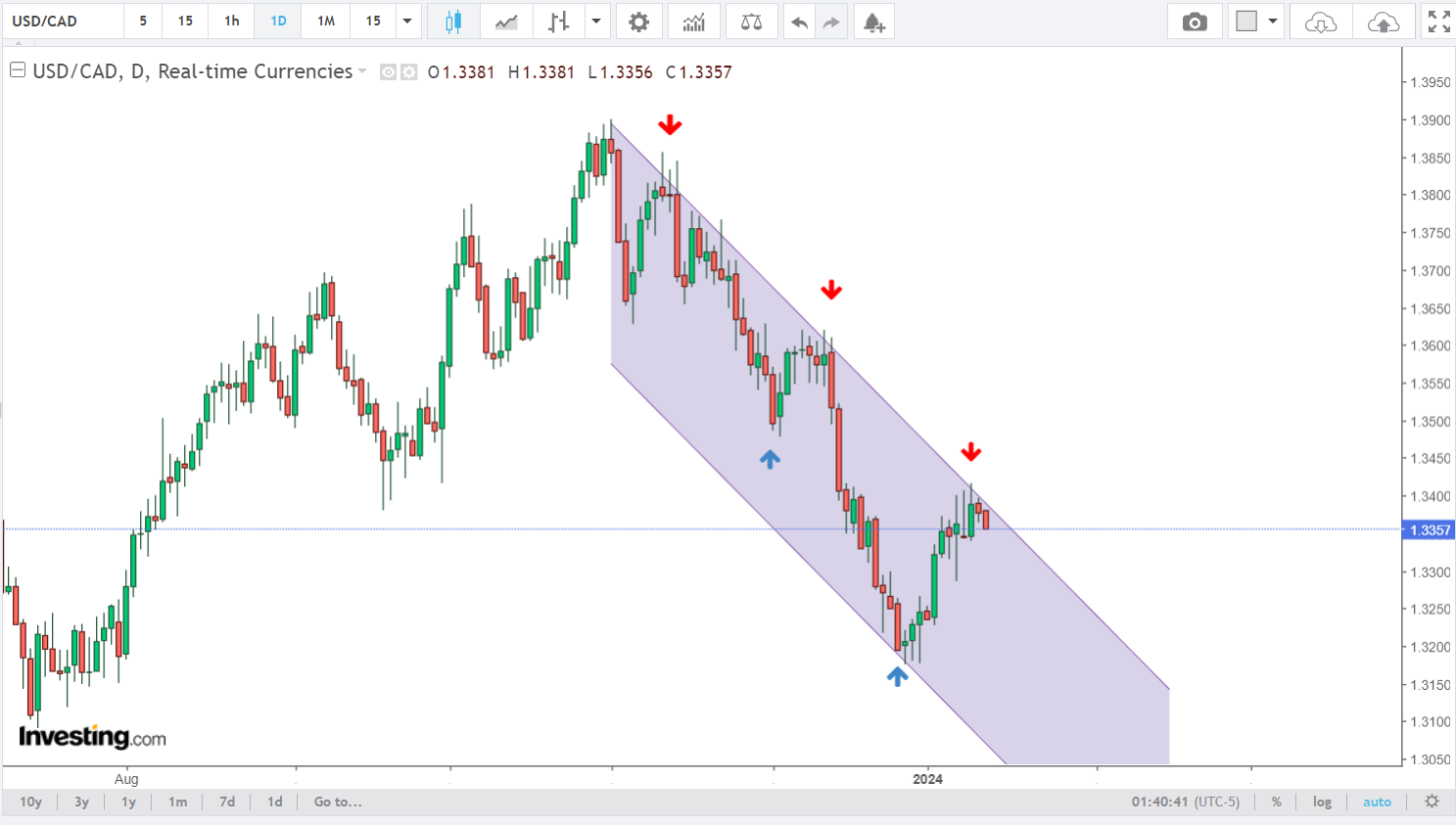

The focus is on USD/CAD. Since the US often sets the standard for monetary policy for the majority of the other nations, there is a link between the global recession and the US, with reference to technical and fundamental analyses.

This is the USD/CAD one-day chart. The dollar has been steadily decreasing since November 2023. Technical analysis indicates that there are higher and lower lows, which supports the downward trend. Subsequently, it is trading within a channel, wherein the price consistently retraces upon reaching the channel’s upper band. So, we should expect a weaker USD given that the Fed will cut interest rates.

At 1.3359, it’s a good moment to start a short trade. We will take a profit around 1.3150, which is also the trend’s low point. We will have a good 2:1 risk-to-reward ratio because the stop-loss level is set at 1.3450.

Basil Goh