Will the banking crisis lead to a recession?

14 min read

Credit risk refers to the risk that loans might default and assets might underperform, resulting in issues like an interruption of cash flows. How a bank’s inability to meet its obligations could potentially threaten its financial position is the liquidity risk that banks have, which could potentially happen if withdrawals were to exceed the available funds in a bank. Interest rate risk presents the problem of reduced value of bonds held by the bank should interest rates rise, forcing the bank to pay relatively more on its deposits than it actually receives on its loans. All these risks could potentially result in bank failures, which may in turn lead to a banking crisis. There are also a plethora of other issues that could lead to banking problems.

How do we define a banking crisis? A systemic banking crisis happens when numerous banks in a nation experience severe solvency or liquidity issues all at once, either as a result of being hit by the same external shock or as a result of one bank’s or a group of banks’ failures spreading to other banks in the system. A systemic banking crisis, in more precise terms, occurs when there are several defaults in a nation’s corporate and financial sectors and when financial institutions and corporations have significant trouble meeting their contractual obligations on time.

The net capital of the entire banking sector is depleted as a result of high increase in non-performing loans. Depressed asset prices, including equity and real estate prices, following run-ups prior to the crisis, substantial increases in real interest rates, and a slowdown or reversal in capital flows may all be present in this scenario to result in banks being insolvent. The domino effect of bank failures results in a banking crisis. In general, when a crisis is about to unfold, it is recognised that systemically important financial institutions are in trouble.

The fear of a banking crisis was pertinent earlier this year when multiple high-profile regional banks failed quickly in March: Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank. The bank collapses were largely due to a lack of deposits, and they occurred weeks before Credit Suisse had its AT1 bonds controversially wiped out by Swiss regulators during the lender’s emergency bailout. Such a scenario is a cause for concern also because these banks weren’t limited to just one geographic area and there wasn’t one single reason behind their failures; there were, in fact, a number of contributing factors.

Before we come to any conclusion about whether the bank failures of 2023 are an issue we should be worried about at present and whether or not it will lead to a recession, let’s explore a little deeper into what took place in March earlier this year.

A little history about how banks work in the US

Smaller banks have traditionally been regarded as the backbone of the United States because they have deep relationships with their local communities and possess local knowledge that Wall Street institutions and giants like JPMorgan Chase simply cannot. Goldman Sachs estimates that small banks account for 70% of all small business loans. Small businesses account for nearly half of all jobs in the US, and they significantly increase the GDP of the nation.

Before the Federal Reserve Act was constituted, the state established banks, and they were limited to just one branch. This meant that every little town had its own bank, and by the 1920s, the number of banks in America had grown to nearly a whopping 30,000.

Although having a variety of banking interests can appear advantageous, limiting the extent of a bank’s operations led to problems, some of which are still evident today. For instance, a small bank simply finds it more difficult to diversify its lending portfolio, which leaves it less prepared to face unforeseen events.

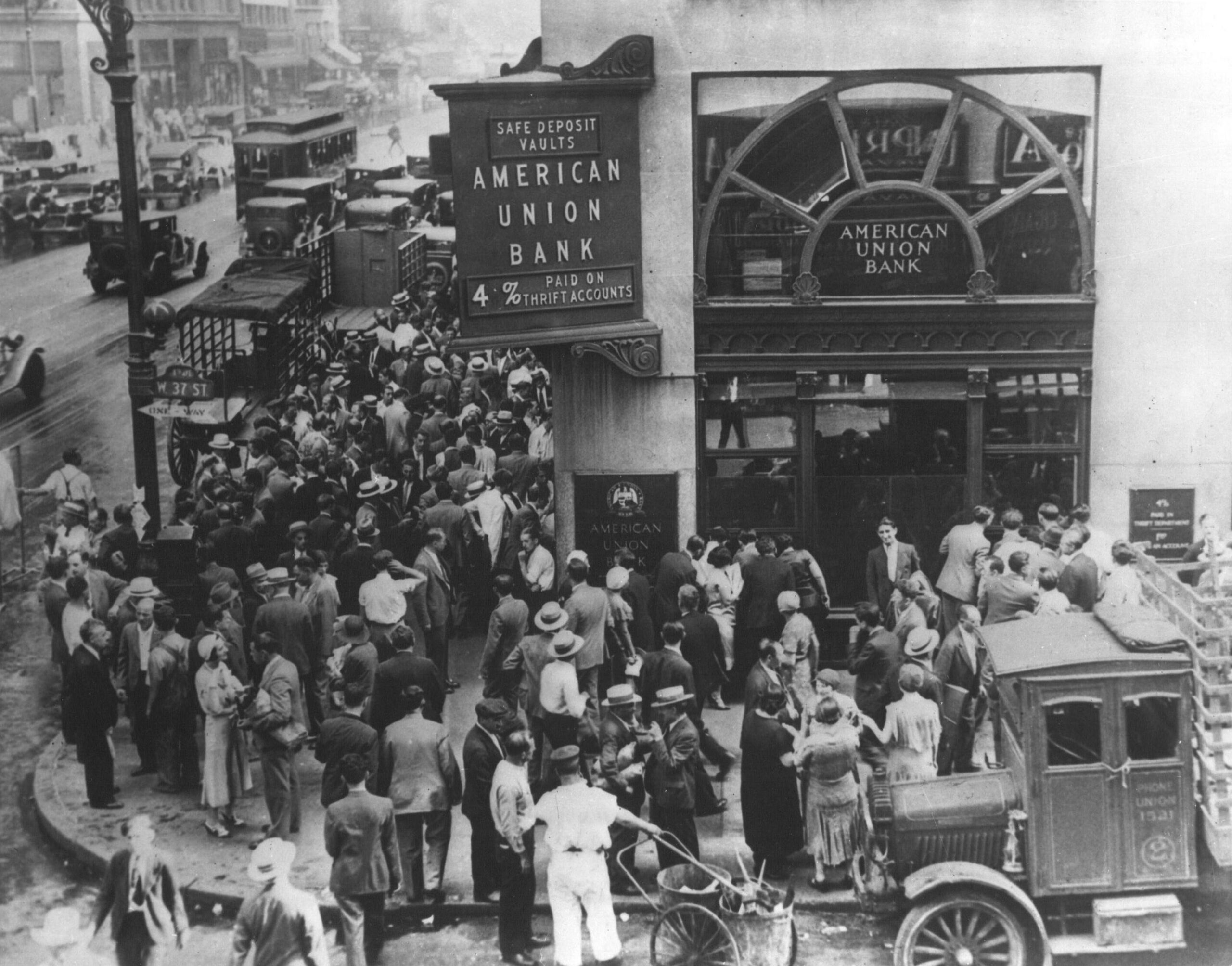

Back then, whenever there were any new events that raised fears in people, which led to the spread of more rumours, they would all run to the bank and demand their deposits back, and that’s how the term ‘bank run’ was coined.

Even today, such actions could drain the bank’s reserves for the very same reason that banks are efficient as depositors and lenders: the fractional reserve banking system. In this system, only a fraction of bank deposits are required to be available for withdrawal, which is the fractional reserve requirement, a percentage determined by the central banks. Thus, if everyone starts withdrawing from the bank, even the most efficient bank could have its reserves drained, forcing them to sell at fire-sale prices. A bank run is like a self-fulfilling prophecy: When its customers start simultaneously demanding their deposits, they cause the bank to become insolvent.

The Federal Reserve was established in order to create a centralised banking body that would maintain some form of regulation within Wall Street and the nation’s financial institutions. Additionally, it established a framework for credit in the US as well as the movement of money—literally, the printing of money. So we would expect financial systems to be much more secure now. However, the changes of today might just be occurring a tad too quickly for some of the banks in America to keep up.

Why was there a series of bank failures in 2023?

The pandemic appears to have been a major contributing factor leading up to the crisis. The onset of the pandemic led to global supply chain disruptions, and it didn’t help that a war was subsequently waged between Russia and Ukraine at a time when we thought we could welcome a post-pandemic era with relief, having just to sort out the issue of supply chain bottlenecks. But post-pandemic issues, coupled with the war, resulted in prices soaring. Inflation became irreversibly rampant between 2021 and 2023, with food, transportation, and utilities costing 20% more than they used to.

Interest rate risk

Interest rate risk was particularly pertinent during this period. One of the safest investments available is believed to be Treasury securities. Many banking customers decided against taking out loans during the COVID-19 crisis and its aftermath and kept their government stimulus checks in their accounts. Banks had few choices other than to invest in Treasury bonds because they are, after all, profit-seeking organisations themselves. In one quarter of 2021, banks reportedly invested $150 billion in these securities. Consumers may have been relieved as a result of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, but banks’ profits were significantly reduced simply because Treasuries yielded far less than the interest rates they would have earned on loans.

Subsequently, inflation rates accelerated, and this only served to make the situation for banks even more challenging. As inflation soared to near double-digit levels in 2022, the Fed was forced to make the difficult decision of raising interest rates and slowing economic growth in order to stop prices from getting out of control. With every hike in the Fed funds rate, the long-term Treasury securities banks held lost value, and this is known as the interest rate risk. The Fed fund rate increased nine consecutive times between March 2022 and May 2023, equating to a total of 5%, and banks suffered dearly.

Real estate sector

The average bank has more than a quarter of its assets made up of commercial real estate loans, and many smaller banks have even more exposure—up to one-third of their total portfolios. With a growing economy and more prosperous businesses, commercial real estate typically sees consistent and sizeable returns. In addition, commercial real estate has long time frames—usually more than five years—and can offer a higher margin for more popular locations.

But the pandemic left the sector battered. As more and more workers started working from home, commercial real estate vacancies skyrocketed, leading to a dramatic decrease in property values. In fact, during the pandemic, we already witnessed vacancy rates shoot up as high as 15%. Rising interest rates upon recovery from the pandemic only served to increase the likelihood of default for commercial real estate loans, compressing building valuations and lessening demand for new development.

Recessionary pressures

When the Fed mentioned a ‘soft landing’ for inflation, it meant it would raise interest rates only to the point where it could contain inflation but not cause a recession. However, its words alone might not suffice to relieve the fears of investors, especially if investors are making their own conclusions regarding the host of different data releases each day used to gauge where the economy stands in its business cycle.

It is common practice for investors to interpret the yields on US Treasuries as well. As a matter of risk and return, longer-term Treasuries typically give higher yields than shorter-term Treasuries. The longer the loan an investor makes to the federal government, the greater their reward should be.

But on occasion, the 10-year Treasury’s yield flips, or inverts, in relation to shorter-term treasuries, such as the 2-year Treasury. When the yield curve inverts, it signals diminishing investor confidence in the US economy since it suggests that investors are placing a larger value on short-term government bonds. A recession could begin anywhere between six months and three years after the yield curve inverts. On April 1, 2022, the 10-year and 2-year note yields swapped directions. Yield curve inversion is the most accurate predictor of financial crises, having predicted almost every single economic recession in 100 years except for one in the 1960s. Coupled with other indicators like spikes in the Volatility index, stock market volatility, and rising unemployment numbers, an impending recession seems likely.

These are all factors that could spell trouble for the entire banking sector. In fact, the three mid-sized banks that collapsed make it evident that such factors do play a significant role. Of course, there were other issues at play that caused each of the bank’s failure.

Three prominent bank failures

For the SVB’s case of insolvency, a bank run was the main reason for its failure. High-net-worth clients of the bank, many of whom had millions of dollars stored in their checking accounts, withdrew $42 billion in one day after the bank disclosed a $1.8 billion loss and rating downgrade in March. It was challenging for the bank to offer enough liquidity to meet these needs due to the interest-rate risk on its long-term reserves.

Federal authorities placed Signature Bank under the Federal Deposit Insurance Corporation’s receivership less than 48 hours following SVB’s failure. This New York City-based bank has a specialised division that focuses largely on bitcoin, private equity, and real estate, all of which were adversely affected by the pandemic. To top it off, it had been under investigation by the US Justice Department over its failure to recognise unlawful activities surrounding Sam Bankman-Fried’s cryptocurrency exchange, FTX, which collapsed in November last year. Such occurrences can also lead to bank failure as levels of fear among banking customers heighten.

The First Republic bank collapse was the most severe case of a crisis. The San Francisco-based bank, which offered wealth management services and targeted software companies, had a 111 percent loan-to-deposit ratio, which basically indicated that it disbursed more money than it held. This risky strategy that helped it gain popularity among many entrepreneurs posed a problem for the bank subsequently.

Additionally, interest rate risk and customer withdrawals were problems for the bank. JPMorgan Chase and 11 other major banks contributed a $30 billion liquidity injection to support the frail financial system after recognising the smoke signal, but First Republic still failed. On April 28, 2023, the Federal Deposit Insurance Corporation (FDIC) eventually took over and sold it to JPMorgan Chase, under whose name all of the branches are now operated.

How is the banking crisis affecting the US economy?

A bleak economic forecast resulted from the first US Fed meeting after the banking crisis began. The concerns are likely to cause the US to enter a “mild recession” in the second half of the year, according to the central bank. The Fed played a crucial role in addressing the banking crisis in order to mitigate the situation.

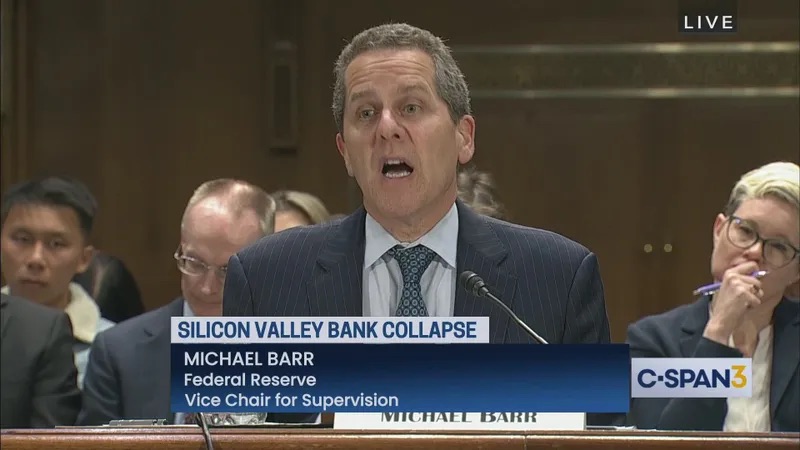

To determine whether the Federal Reserve Board’s reaction to the crisis may have been improved, Michael S. Barr, the vice chair for supervision of the board, wrote an assessment of the SVB collapse. In the report, he stated that “in light of Silicon Valley Bank’s failure, we must tighten the Federal Reserve’s supervision and regulation based on what we have learned.”

The Fed views the failures as outliers of a sound and robust system with strong capital and liquidity, rather than a sign of the market’s overly optimistic health. The evaluation also blamed SVB’s board of directors and management for the company’s inability to manage risks, but it urged the Fed to enhance oversight and regulation at the same time.

While a liquidity run was the immediate reason for SVB’s demise, some claim that worries about the company’s health lay at its core. However, it does feel that the worries about the state of the banking industry have been downplayed when the crisis was simply resolved by an acquisition supervised by regulators. Are concerns about the health of the banking sector in general actually valid? And is a recession really on the way or, in fact, already underway?

The banking crisis and recession

Approximately five months after the bank failures, the US economy is plugging along with inflation subsiding and unemployment remaining near lows it last enjoyed in the 1960s, while GDP growth for the first quarter was even revised upward. It does appear that the US is not facing a recession, as predicted by many analysts. However, that doesn’t mean that a recession isn’t going to happen or isn’t, in fact, underway now. We are talking about a global recession here.

The world economy is currently in recession because of the 1.2% global GDP growth rate. Even in the absence of a direct decrease, growth rates of less than 2% are sufficient to constitute a global recession. The global economy experiences an average growth rate of roughly 2%; anything below that figure indicates that the economy is functioning below normal. In reality, the global economy hardly ever experiences a full-fledged downturn. In the past 100 years, this has only happened three times: during the Great Depression, the Great Recession, and most recently, the COVID-19 pandemic.

Data from some of the biggest economies in the world appear to support such an argument. According to figures from the International Monetary Fund, South Korea’s GDP growth this year was 1.5%, whereas France’s GDP growth was 0.7%. The United States, which has the largest economy in the world and has led the developed world’s post-pandemic recovery, may be an anomaly with its 5.4% GDP growth compared to the end of 2019, especially in light of the fact that advanced economies are expanding at an average rate of 1.3% this year.

That being said, domestic and global recessions may not always coincide because individual countries may experience different economic outcomes than the world as a whole. However, one main concern is the rising unemployment rates on a global scale. China’s 20% unemployment rate among youths between ages 16 and 25 is evidence of lagging economic opportunity worldwide, a problem that is also affecting the European Union, where youth unemployment was 13.9% in May. The US is an anomaly here, with an unemployment rate of only 3.5%. These are crucial data because, as more people enter the labour force, disposable income generally improves. Youth unemployment is frequently regarded as a predictor of future social mobility and consumer expenditure.

The JPMorgan global manufacturing PMI, another important indicator of the strength of the world economy, gauges worldwide manufacturing production, and its value plummeted to 48.8 just last month. Less new order intake, or weak global demand for new goods, was the primary cause of the sustained decrease in global manufacturing. The data from S&P Global shows that this pattern has persisted for a full year. In addition, the price of Brent crude oil has decreased from $79.54 per barrel this year from $100.94 in 2022. Chemical companies have also not kept pace with the S&P 500’s 16% increase, as indicated earlier. In fact, over the past six months, the performance of Fidelity’s index fund that follows chemical companies was -8.64%.

Overall, the global economy appears to be in a slump, and the Fed and the central banks across Europe might very well exacerbate the problem as they tighten policies further. Until aggregate demand increases sufficiently across the globe, many nations are at risk of a possible recession, if it is not already underway.

A Trader’s View

The USD started declining late 2022 after the Fed announced they will slow the pace of rate hike in 2023. This announcement was made in response to the decline in inflation in the US after it peaked in June 2022, while the major economies such as the UK and Euro Area were still battling high inflation. This slowdown in inflation, coupled with the Fed funds rate halt and the threat of recession, further pushed the decline of USD.

The above image is the day chart of XAU/USD which is also known as Spot gold. As indicated in the chart, Gold price has been trending higher with higher high and higher low observed. Current market conditions indicate that the US dollar will decline further in the short to medium term and we anticipate that USD will remain subdued until the threat of inflation is lifted from other major economies.

Short term Buy target: 2050 ~ 2070

A break above 2070 could see prices reaching 2150 ~ 2180 in the medium term.

Terry Loh